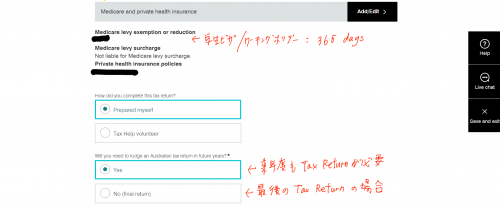

What is full Medicare exemption? Who is exempt from Medicare? Work out the number of days that you qualify for full exemption and then enter the number into Full levy exemption – number of days.

If No, go to step 6. Medicare levy Members may be entitled to a full or half Medicare levy exemption. You do not have any dependents. A full exemption from the levy may be claimed where: You are entitled to full free medical treatment for the whole of the relevant financial year. People who earn less than a specified amount qualify for a Medicare Levy exemption. To claim your Medicare Levy Exemption , you need a Medicare Entitlement Statement from the Department of Human Services.

No, prefill application here, sorry. To get the statement, you must fill out an Application for Medicare Entitlement Statement form. Half Medicare Levy Exemption. You meet any of these conditions. You could also be exempt from paying the Medicare Levy if you: Meet certain medical requirements: Pensioners who are blin those who are entitled to full free medical treatment for.

Are a foreign resident: You can claim a full exemption from the Levy if you were a foreign resident for the whole. Where payee’s earnings are more than $5but less than $45 the weekly withholding amount. Ignoring cents, find $4in column and refer to the corresponding amount to be withheld of $24. The employee has claimed a tax offset of $0on the Withholding declaration.

To work out their weekly entitlement, take 1. This diacludes: Medicare Levy Exemption Categories. Part Year Residency. Download and complete the Application for a Medicare Entitlement Statement form. To complete the form electronically, save a copy of the form before you start filling it in.

Other tax tables may apply if you made payments to shearers, workers in the horticultural industry, performing artists and those engaged on a daily or casual basis. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. A medicare levy exemption is only valid for tax scales and 7. Number of Dependants. The number of dependants field is used in conjunction with the Medicare Levy Exemption field. This field is to hold thenumber of dependants that the employee has declared on their ‘Medicare Levy Variation Declaration’.

The rebate field holds the key to the type of rebate that the employee is eligible to receive. The medicare levy is charged at of your taxable income. An ADF employee with a taxable income of $80that is entitled to the 1 medicare levy exemption will save $600. Neither of us pay medicare levy , only half levy for children.

Thanks for the responses, my case is a bit complicated so will contact the ATO to clarify as there is no information online that I can find. The exemption is based on the employee’s taxable gross earnings and on the number of his or her dependents. The first is the Medicare Levy and the second is the Medicare Levy Surcharge.

The Medicare Levy is one basic way that most working Australians contribute toward the cost of Medicare. Most people pay the Medicare Levy. However, there is still an exemption for low income earners.

Who Pays the Medicare Levy ? These include members of the defence force and certain recipients of repatriation and social security pensions and benefits.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.