Can I nominate a beneficiary of my superannuation? Can superannuation death benefits be paid? What is death benefit nomination? Who is eligible for superannuation? Pension death benefits : QA.

Death benefit payment options. My client’s husband has passed away and she is the beneficiary. She wants to use dependant’s drawdown but.

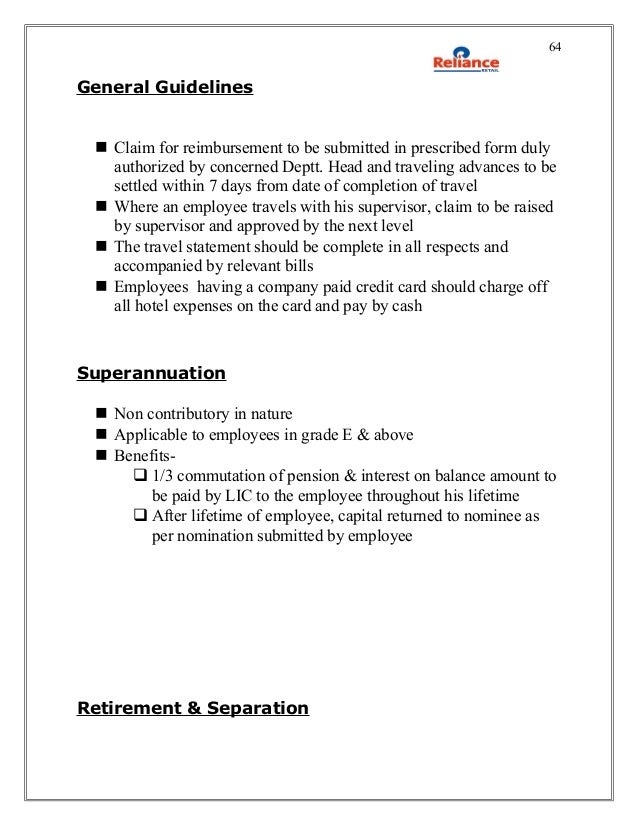

Lifetime Allowance implications (including excess charges) Tax on payments (income and IHT) Inheritance tax. The change in the taxation of death benefits from age may also act as a prompt to review nominations. You can also cancel or change a previous nomination. If you do not make a death benefit nomination , the trustee of the super fund may decide to pay your death benefit to your estate, or it may use its discretion to decide which of your eligible beneficiaries receive the death benefit. A death benefit nomination is a formal nomination by a member to the trustee of a superannuation fund as to who the intended beneficiary of their superannuation benefits will be upon their death.

Depending on the terms of the superannuation fund dee the nomination can be binding or non-binding and lapsing or non-lapsing. A person with whom the member had an interdependent relationship. This could be a family member, a friend or a charity. If you are a member of classic-plus, premium, nuvos or alpha, you can choose multiple nominees.

Now a nominee or nominees can also receive a drawdown pension. This is called nominee flexi-access drawdown. And on their death, a successor or successors can take a drawdown pension. This nomination may be non-binding or binding. With direction, the scheme administrator has no choice – they have to pay the death benefits to those named on the nomination form and the beneficiaries have to accept it even if they would rather it was paid elsewhere e. No tax-free cash is available on establishing the nominee or successor flexi-access drawdown plan.

No contributions can be paid to the flexi-access drawdown plan. Income payments to the nominee or successor are paid tax-free if the predecessor died before age 75. In most cases, lump sum death benefits are paid at the discretion of the pension scheme trustees or providers even where there is a nomination that expresses a wish as to the beneficiary. Superannuation does not form part of a person’s estate and the superannuation trustee will have some discretion as to how the benefits are paid where there is no binding death nomination in place. Elizabeth McIntosh applied for and was granted a Letters of Administration from the Supreme Court, making her the Legal Personal Representative of his estate.

Additionally, when there is no binding nomination after someone’s death the trustee’s decision can be reviewed and challenged by any potential beneficiaries who are unhappy with the result. This complaint process can delay the payment of the superannuation death benefit , sometimes for years. Nominating a beneficiary allows the trustee of your superannuation fund to know where to pay your super death benefit when you die. Where the deceased is over 7 benefi ts will be subject to tax.

Ideally you would make a nomination to guide the trustee. The superannuation fund is required by law to pay the death benefit to the dependants, interdependent or the estate if there is no binding nomination and to the nominated beneficiaries, if there is a binding nomination.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.