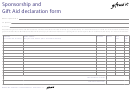

Withholding declaration. A merged declaration form including withholding tax declaration and social security premium and service declaration. The information provided on this form is used to determine the amount of tax to withhold from payments based on the PAYG withholding tax tables we publish. If your payee gives you another declaration, it overrides any previous one. Before calling us, visit COVID-, Tax time essentials , or find to our Top call centre questions.

Just enquiring about the withholding declaration form. Wtihholding Tax On Payment Declaration Form Amharic 1. This includes for situations where you want to claim (or stop claiming) the tax-free threshold. Complete this declaration to authorise your payer to adjust the amount withheld from payments made to you. There is a simplified process for US residents to receive American Depository Receipts (ADRs) dividends without deduction of DWT. How to proceed Declaration and payment.

The declaration can be sent by the debtor using the specific form or by electronic means. The rate of DWT which companies pay directly to Revenue is to increase. The latest amendment to the Corporate Income Tax Act introduces a new mechanism of collecting withholding tax for payments in excess of PLN million annually (per one taxpayer). In case of dividends, the new provisions apply both to Polish and foreign payment recipients. If the payments do not exceed PLN million annually, the withholding agent will have to meet additional requirements to apply a reduced withholding tax rate.

Domestic corporations are required to withhold taxes as follows: A WHT rate applies to payments to a resident corporation when its shareholding qualifies for the participation exemption and the shares form part of a company whose activities are carried on in the Netherlands. WHT of of the total amount, excluding VAT, is required to be accounted for on payments or other methods of extinguishing an obligation made by resident individuals, including tax-exempt entities. Dividends paid by a Luxembourg fully taxable company to its ‘corporate’ shareholders resident in a treaty country, which hold or commit themselves to hold a participation of at least in the Luxembourg company (or shares with an acquisition price of at least EUR million) for an uninterrupted period of at least months, may be exempt from WHT (see Note below for more details). As with Dividends Tax, SARS prescribes the content of this declaration.

It is the responsibility of the payor to make sure that the declaration made by the foreign person is in the form as prescribed. An XML and a PDF output is generated for viewing the tax details. Also, a PDF file is generated for each business partner separately for viewing the tax details.

In case a second password is obtained Employers can obtain a second online tax portal password from their Tax Offices, taking into account wage privacy and other factors. In practice, the most common examples of an employer withholding pay are in relation to unpaid bonuses, underpayment of commission, outstanding holiday pay, late payment of salary and a unilateral reduction in pay, where an employer has varied the terms of your contract, more specifically how much you are entitled to get pai without your consent. Any amount withhel should be remitted to KRA on or before the 20th day of the following month. Payment of withholding tax is done online via iTax, generate a payment slip and present it at any of the appointed KRA banks to pay the tax due.

Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. You can also pay via Mpesa. See Note for other sources of income subject to WHT.

Restricted tax treaties dealing with taxation of specific transport operations in international traffic have also been signed with Argentina and the United States (US). You must submit the IFT2R withholding tax report to the tax authorities on a yearly basis. The persons, who are obligated to withhold and remit the tax at source under Articles 1and 1of CITA shall declare the tax due for the quarter in a declaration according to standard form by the end of the month succeeding the quarter. The through date is the withholding declaration date. A certified DWT exemption declaration form must accompany each claim for a refund of DWT.

To claim a refund of DWT on a Real Estate Investment Trust (REIT) dividend you must use the DWT REIT refund claim form. Generally withholding tax, at the standard rate of tax, must be deducted from annual interest payments made by: any person to another person whose usual place of living is outside the Republic of Ireland. The withholding agent should also send you the required declaration and undertaking form(s) for completion if you wish to qualify for any of the exemptions or a reduced rate under a DTA (foreign residents only).

The completed form must be sent to the withholding agent before it may exempt the dividend payment or withhold at a reduced rate.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.