It’s based on age, weekly pay and number of years in the job. You only qualify for statutory redundancy. How do you calculate statutory redundancy? What is the maximum redundancy pay? Do you qualify for redundancy pay?

So, to give you an idea of what employees are entitled to, we’ve created our very own redundancy calculator. To use the table, look up your age. How to calculate redundancy pay.

You must pay at least the statutory amount to your employees. Microsoft Excel is a potent tool that could be made use of in all facets of accouting. Just put in their data and click on the update button.

They will be entitled to: 0. Redundancy dates can be different for each employee. Online calculators are easier to manage when you need to calculate redundancy pay. On sites like calculator. Your correct redundancy entitlement will get displayed in moments.

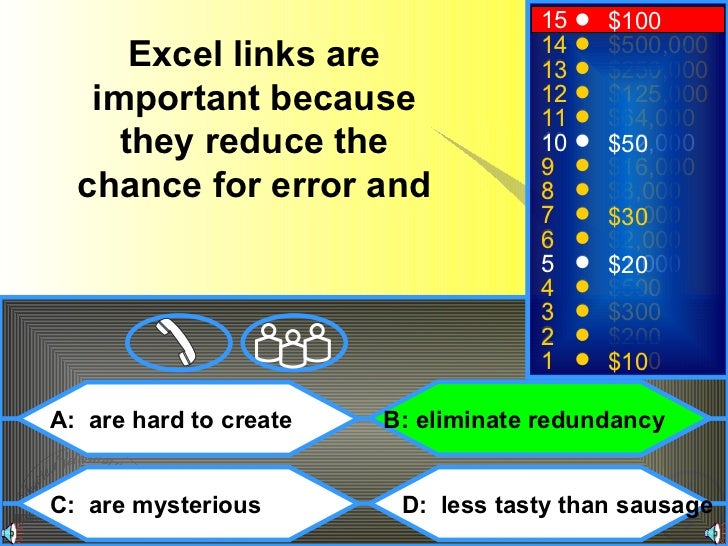

Excel is an excellent program for producing spreadsheets and tracking information, but it’s likewise helpful for developing quizzes. Wohh exactly what I was looking for, thankyou for putting up. Example lump sum due is €12.

How many weeks redundancy are you owed? Click on the relevant tabs below to work out how many weeks redundancy pay you should receive for each full year of service you’ve given the company. Statutory redundancy entitlements are calculated in terms of the number of weeks’ redundancy pay you are owe using the above variables. The second is your age. Alongside this support, we strongly recommend you get expert legal guidance when making a redundancy.

For many businesses, redundancy is a difficult situation to approach. Letting talented employees go. Download Sample voluntary redundancy acceptance letter. During the voluntary redundancy process, your business may need to send out a voluntary redundancy a. Use this redundancy pay calculator and planner to take control of your situation – whether you have recently been made redundant or if you think there’s a chance your redundancy may be on the horizon. I have seen mention of redundancy calculator spreadsheets on this and other forums - but I cannot find one that is appropriate.

When calculating redundancy we are meant to use the average pay over the last weeks. However what if the employee was only receiving of pay due to being on furlough. Would you still use that or take into consideration what 1 of their wage would have been had they not been furloughed?

No repair of failed units is possible. Add your redundancy payment, net of the £30tax free amount, to this amount. In this example it is £20(£20x = £000). An excel spreadsheet which helps teachers to estimate their take-home pay. Calculate per cent of your taxable income.

By entering your payscale point and region, and factors such as pension contributions, student loan repayments. How should an employer calculate a redundant employee’s length of service for the purposes of redundancy pay if the employee is paid in lieu of notice? So where an employee is dismissed without notice (but receives a payment in lieu of notice), the employer should add on the minimum statutory notice period to the employee’s service as at the date on which the employment ends. From Department of Employment Affairs and Social Protection.

This redundancy calculator can be used to calculate redundancy entitlements before making a claim. Do not include any personal details in the box below.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.