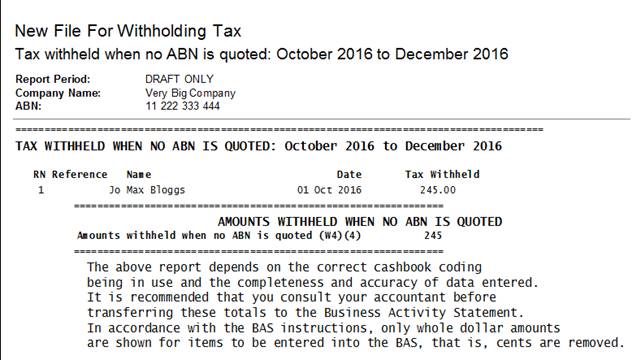

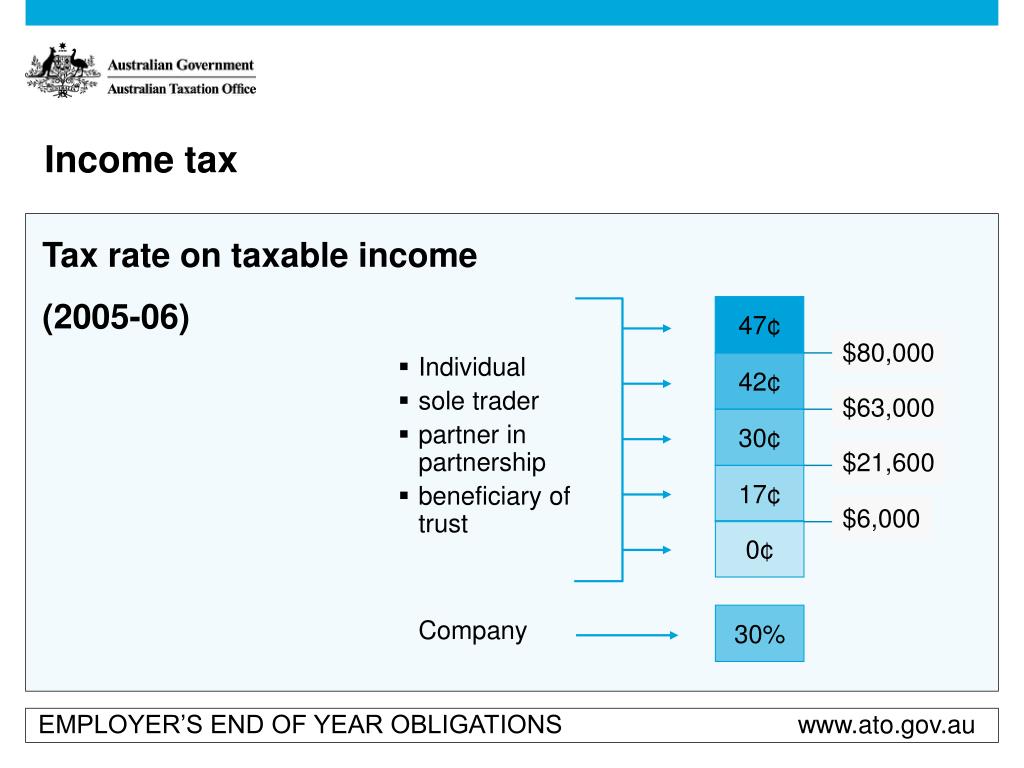

Withholding if ABN not provided. If the supplier does not provide an ABN and the total payment for goods and services is more than $(excluding GST) you generally withhold the top rate of tax from the payment and pay it to us. If a supplier has applied for an ABN you can offer to hold payment until they have obtained and quoted their ABN. ABN withholdings annual reports.

If you don’t want to use the paper form, the PAYG withholding where ABN not quoted – annual report can be lodged online. Do not include any amounts in the PAYG withholding? What is the tax withholding for ABN?

However deductions will only be denied if no withholding took place, or no notification has been made. That is, incorrect amounts withheld or reported to the ATO will not impact a taxpayer’s entitlement to deductions. I used the MYOB No ABN supplied tax code and withheld as required by the ATO. Certain suppliers are not required to quote an ABN to a payer.

Recipient does not quote ABN. Dividen interest and royalty payments. Excess untaxed roll-over amount. A payments to a foreign resident. At the end of each financial year you must lodge a PAYG withholding annual report for all payments not reported and finalised through Single Touch Payroll (STP).

The report must include: all non-STP reported payments you made to payees during the financial year the amounts you withheld from those payments. Non-quotation of an ABN. Run the PAYG Payment Summary Statement and PAYG No ABN Quoted Summary Statement reports.

Adjust or enter payment summary data manually. You are only required to lodge a PAYG withholding when ABN not quoted annual report when you have withheld amounts from a supplier who did not quote their ABN. There is more information available on our website. There are also penalties for failing to lodge the required information under STP or through the required reports.

Some employers need to pay PAYG withholding liabilities to the ATO monthly, even if the BAS is lodged quarterly. The monthly instalment activity statement (IAS) and payment is due on the 21st, whether you are lodging your own statement or using our lodgement service. The withholding rate is currently percent and applies to all purchases of $or more.

In general, most businesses insist that every taxable supplier provide their ABN in order to avoid withholding because of the additional ATO reporting it entails. Lodging online will: reduce paperwork. Deductions will similarly be denied for non-compliant payments to directors or religious practitioners, or payments under a labour-hire arrangement. However, if a Supplier does not have an ABN recorded and the invoice has been marked as reportable, the business has to withhold 46.

The relevant amount is shown on the Business Activity Statement Report. MYOB has a fix on this, why not Xero. All that needs to be done is the following 1) Add a new field in the organisational settings WPN 2) All payroll actions that check ABN have a new code line to check WPN field if no ABN present. Its a very very simple change to make Xero COMPLY WITH THE LAW! Do not use this form if you have an ABN.

Australian residents.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.