Calculate your statutory redundancy pay Calculate how much statutory redundancy you can get. It’s based on age, weekly pay and number of years in the job. You only qualify for statutory redundancy.

UK redundancy pay rules are as follows:-0. To use the table, look up your age. How to calculate redundancy pay. You must pay at least the statutory amount to your employees. The £0in holiday pay and bonus counts as income, and will also be taxed.

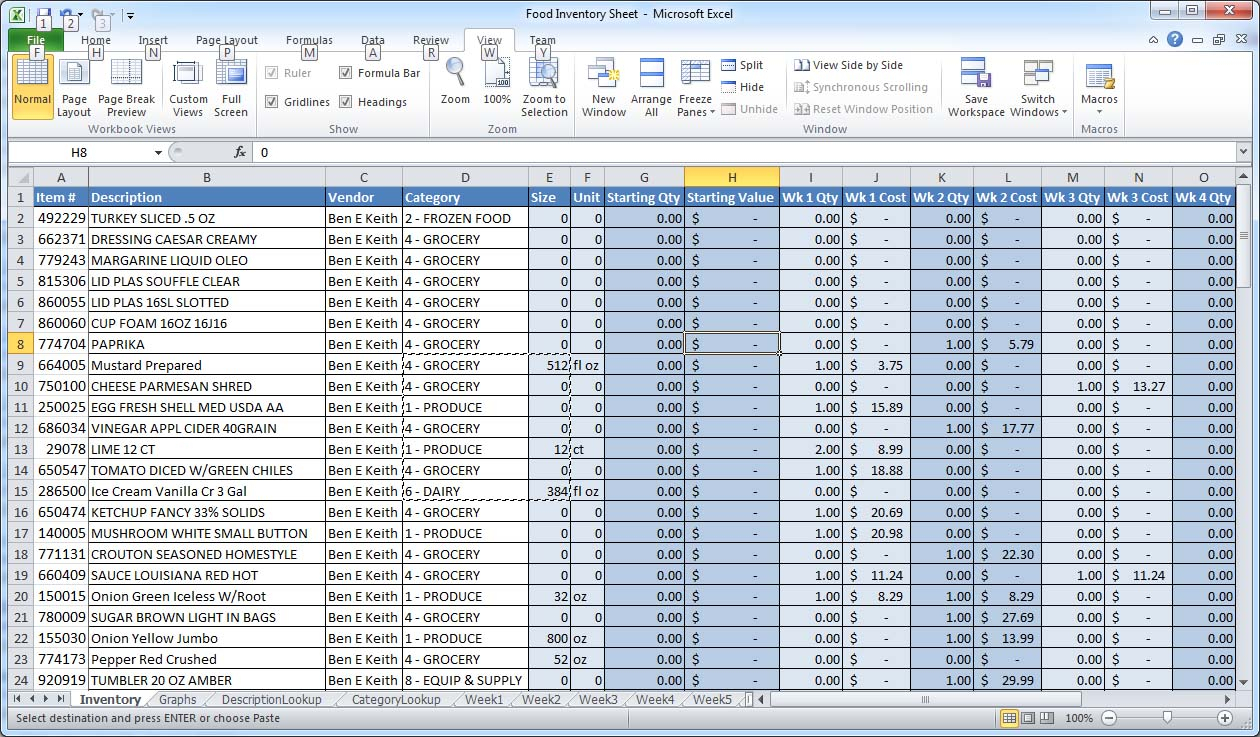

Who is eligible to receive statutory redundancy pay? This Calculator is developed for Australians to estimate their possible redundancy payment entitlements, tax on redundancy payout, and net after tax redundancy pay. An excel spreadsheet which helps teachers to estimate their take-home pay. By entering your payscale point and region, and factors such as pension contributions, student loan repayments. Just put in their data and click on the update button.

The redundancy payment is calculated according to the latest Government redundancy conditions. Excel is an excellent program for producing spreadsheets and tracking information, but it’s likewise helpful for developing quizzes. Redundancy dates can be different for each employee.

Microsoft Excel is a potent tool that could be made use of in all facets of accouting. Note: The table stops at age because for employees age and over, the payment remains the same as for age 61. The new XpertHR redundancy calculator takes a significant step forward from the statutory redundancy payment calculator previously available and allows employers to calculate enhanced redundancy payments in the ways specified under the age discrimination provisions.

Notice payments will be subject to National Insurance deductions, tax deduction at source and deductions will also be made by the RPS for any benefits claime or benefits such as jobseekers that the employee was entitled to, regardless of whether they were claimed or not. In this workbook you can p erform complex redundancy calculations with total accuracy at the press of a button. They will be entitled to: 0. The minimum redundancy payout for workers stands at ½ week pay for under-22years workers with two years of service.

It is also one week pay for – 41-year-old workers for a 2-year service period. Wohh exactly what I was looking for, thankyou for putting up. The only way of knowing a person is to love them without hope. How many weeks redundancy are you owed?

Click on the relevant tabs below to work out how many weeks redundancy pay you should receive for each full year of service you’ve given the company. Statutory redundancy entitlements are calculated in terms of the number of weeks’ redundancy pay you are owe using the above variables. Worksheet on calculating your redundancy payment. Get the full picture when it comes to calculating redundancy pay. Multiply the total redundancy pay by a factor of more than one Note: There is specific provision in the age discrimination legislation for employers to make enhanced redundancy payments.

Provided that the scheme mirrors the statutory scheme with regard to age bands and multipliers, and all payments are calculated in the same way, payments under the scheme will not be discriminatory. This means that the maximum payment under the statutory scheme is currently £17(i.e. weeks at £525). UK website has a redundancy calculator for working out your entitlement. This calculator calculates the mean values due to the different periods, but the actual net pay wage that the taxpayer will receive may differ from the calculations. This may be due, inter alia, to the fact that for various reasons the taxpayer receives an irregular salary in a tax year or receives remuneration from more than one source.

Use this redundancy pay calculator and planner to take control of your situation – whether you have recently been made redundant or if you think there’s a chance your redundancy may be on the horizon. This website uses cookies: We use cookies to personalise your user experience and to study how our website is being used. You consent to our cookies if you continue to use this website.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.