Are You a family dependant or a dependant? Example 1: A member is single and has no dependants and no private patient hospital cover. Full and half exemptions are available for blind pensioners, those on a Centrelink. If you were a foreign resident for the entire income year, you can claim. Qualify for a foreign residents exemption.

Use this information to work out which income threshold and MLS rate apply to you. You can complete this form by either: ATO online via myGov. You need to consider your eligibility for a reduction or an exemption separately.

All of these limits and rules are not applicable if the person or persons in question are in possession of private health insurance. We have two dependent children. We both make just over $90K. He wants me to take him off our existing family health cover plan and does not w. For family and family’s with dependents the threshold goes up for each dependent child.

You may also qualify for a full exemption under this category if you were a member of a diplomatic mission or consular post in Australia, were not an Australian. You are also eligible if you have had a kidney transplant and are the spouse or dependent children of a person who has worked the required amount of time. The surcharge is calculated at the rate of to 1. Married couple, living together, both eligible for SAPTO, no dependent kids. This is if the Superannuation is paid directly to your adult children (rather than into your Will).

Medicare levy example. The threshold for singles is increased to $2655. The family threshold is increased to $35plus $3for each dependent child or student.

To complete the form electronically, save a copy of the form before you start filling it in. If there are no children you must key a zero. The tables below outline the income thresholds and the MLS rates that are currently in effect. The amount of MLS you’ll have to pay will depend on your income. Generally speaking, there is no simple way to back out.

A dependent is classified in this case as any children under years of age, or any children who are full-time students and are under years of age. It applies to a person and his or her dependents , including his or her spouse. The base income threshold is $90for singles and $180for families.

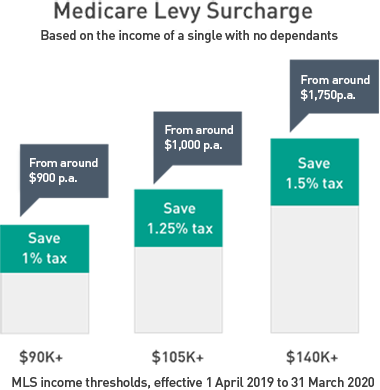

The Levy shades in at for every dollar where family income exceeds the threshold. There is no ‘phase-in’ limit as there is with individuals since the figures change with the number of dependents. Once you earn over $900 the surcharge amount depends on your income tier. The function only calculates the levy for individuals (not trusts).

The percentage surcharge you pay depends on your income threshold as a single person or your combined income as a family, which includes single parents and couples (including de facto couples).

No comments:

Post a Comment

Note: only a member of this blog may post a comment.