Out Of Users Are More Confident Their Taxes Are Done Right. Making Tax Digital Compliant Software. No Obligation To Buy. The first $million is subject to a withholding rate.

Just like that, your bonus shrinks to $ 280because $220goes to the IRS right off the top. Claim a tax refund You may be able to get a tax refund (rebate) if you’ve paid too much tax. Normally, you have to file a gift tax. How do you calculate taxes on a bonus?

How to calculate payroll taxes on a bonus? What is bonus percentage? Tax Bonus : New Law Passed to Allow 10. This has now passed and legislated. Expect delays if you mailed a paper return.

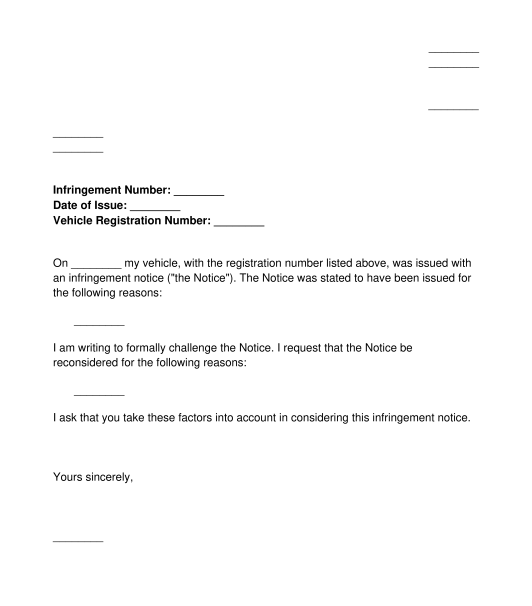

The calculator assumes the bonus is a one-off amount within the tax year you select. If you have other deductions such as student loans you can set those by using the more options button. Your date of birth – it helps get your tax right DD MM YYYY. Your employer may choose this option if it pays your bonus separately from your regular earnings or otherwise distinguishes your bonus from your regular earnings.

Self-assessment tax returns must be submitted each year by self-employed people, but also those with many other types of income. You can make a change to your tax return after you’ve filed it, for example because you made a mistake. Your employer can withhold federal income taxes from your bonus at a flat or may give you your bonus along with your salary and use the aggregate amount to figure out the withholding.